Share On Social!

Since COVID-19 swept the nation in 2020, it seems that adversity is everywhere.

And now – in the summer of 2022 – inflation has reached a record high (9.1%) since November 1981, increasing the cost of gas, groceries, utilities, rent, and other necessities.

Could the COVID-19 pandemic be to blame? And how does the rising cost of living impact Latinos?

Here’s what you need to know.

Update: On August 16, 2022, President Joe Biden announced he will sign the Inflation Reduction Act of 2022, which will help fight inflation by lowering energy and healthcare costs, and by bringing down the federal deficit – the government’s outstanding debt.

More information on how this policy will affect healthcare can be found through the Centers for Medicare & Medicaid Services and their FAQ page.

Additionally, a timeline of how the Inflation Reduction Act will be implemented is now available.

What Caused Inflation?

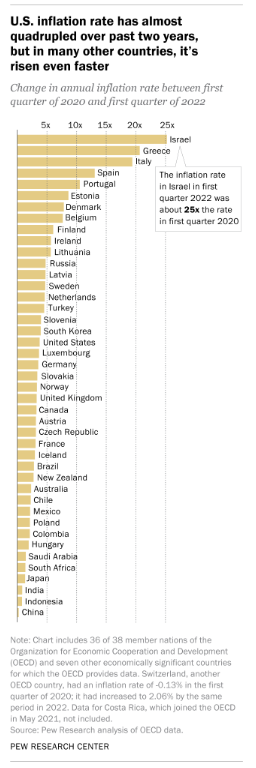

The exact cause of current US inflation is multi-faceted, and it’s important to note that other countries are feeling the effects of inflation, too.

While some inflation is attributed to the COVID-19 pandemic (2.5 percentage points), world events, such as the war in Ukraine, have also played a role.

While some inflation is attributed to the COVID-19 pandemic (2.5 percentage points), world events, such as the war in Ukraine, have also played a role.

Nevertheless, the pandemic contributed to inflation primarily by causing disruptions to the balance of supply and demand for goods and services.

For example, the pandemic caused many people, especially Latinos, to lose their jobs. At the same time, the demand for certain goods, such as housing, rose.

But with a shortage of workers to both build and supply the materials needed to construct homes, demand for housing far exceeded supply. As a result, the cost to buy a home has skyrocketed nearly to 20% in the last year alone, pricing many low-income and first-time buyers, including Latinos, out of the market.

The cost of rent has also increased since the beginning of the pandemic for similar reasons, pushing many families to make difficult decisions about where to live.

How Are Latinos Affected by Inflation?

Before the pandemic, Latinos were already severely housing-cost-burdened, and inflation has made matters worse.

Many families are struggling, especially low-income families that spend more income on living expenses, such as Jacqueline Rodriguez, a Latina living in Miami.

When the pandemic hit, Jacqueline was laid off from her job. To make matters worse, her landlord increased her rent by $300. To make ends meet, she exhausted her savings and continues to struggle paying for the rising cost of gas and groceries on her new job’s $13.50/hour salary.

“It’s outrageous how much everything has gone up,” Jacqueline told the Washington Post. “I go to the supermarket to buy chicken, and I have to make a decision on what meal I’m going to cook based on the prices.”

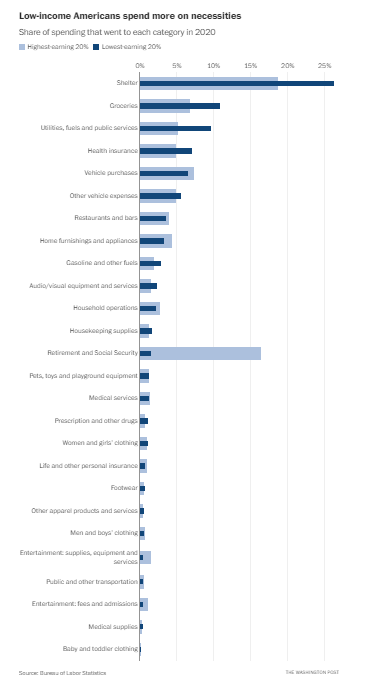

In comparison, higher-income families are less burdened by inflation, as they spend more of their budget on retirement and social security, according to the Bureau of Labor Statistics. They may also have fixed-rate mortgages and investments that help maintain a financial cushion.

“For low-income Americans, a small change in disposable income is very difficult to cope with,” Xavier Jaravel, a London School of Economics professor, told the Washington Post. “Every bit of additional inflation just reduces purchasing power. If you have a large income, which often goes with the fact that you’re saving a lot, then losing some of your purchasing power is not a big cost.”

What’s more, COVID-19 variants are on the rise, and other health threats like monkeypox also threaten people’s ability to work.

For Latinos, who are more likely to hold hourly jobs with no or little paid time off compared to their White peers, missing work due to illness is devastating during these inflated times.

Yet, Latinos remain behind in vaccination rates, a public health issue rooted in misinformation and systemic discrimination.

Will Inflation Improve?

It is difficult to predict when consumers will get a break from rising prices.

Price drops depend on many factors, including the status of world events that are out of the average American’s control.

However, economists and research studies suggest 2022 will see the highest inflation percentages, with prices falling in 2023.

How Can I Save Money?

While the effects of inflation are unavoidable, especially for low-income families such as Latinos, budgeting can help.

For example, when grocery shopping, limit your purchasing of meats, poultry, fish, and eggs, which have increased the most in price. You can offset grocery bills by having one or more meatless meals a week. Ask your family for recipe input to make money-saving dinners more fun.

Couponing and shopping for items on sale also helps, and local food pantries can help keep more cash in your pocket.

You may also qualify for government assistance programs, such as Supplemental Nutrition Assistance Program (SNAP), or the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), which can help save on grocery costs.

While driving, you can also take note of the cheapest gas prices for your next fill up. Take public transportation or bike or walk whenever possible. Carpooling may also be a good option to save money.

Still, many of these actions are out of reach for Latinos.

“A widening socioeconomic gap, racism, and discrimination contribute to inequitable distribution of healthcare and mental and physical health disparities among Latinos and other people of color and those in poverty, especially amid COVID-19,” according to a Salud America! research review that recommends individual and systemic changes.

Addressing underlying health inequities is critical.

For example, here are 10 policies to cut child poverty over the next decade.

“Evidence suggests a lack of economic resources compromises children’s ability to grow and achieve in adulthood, hurting them and the broader society,” said Greg Duncan of the University of California, Irvine, in a news release.

Latinos Stick Together

While its easy to give advice on how to save money, its much harder to budget through life’s curveballs. It is understandable to feel worried and stressed during these hard economic times.

Many Latinos are feeling the effects of the current economy, seeking paths of resilience together by sharing expenses and helping one another out.

Seyli Molina, a Latina from Louisiana, keeps a positive mindset despite economic challenges.

“You can take things with a grain of salt or a grain of sugar,” she told the Christian Science Monitor. “I take mine with sugar.”

Explore More:

HousingBy The Numbers

56.9

percent

of Latinos are "housing cost burdened"