Share On Social!

The Tax Cuts and Jobs Act aims to give an economic boost to hardworking Americans.

But it’s not working that way, some experts say.

The Tax Cuts and Jobs Act actually rewards top-income earners, and expands the ever-growing wealth divide between whites and Latinos and others, according an Institute on Taxation and Economic Policy (ITEP) report.

“These tax cuts reward existing White wealth at the expense of the economic security of households of [people of different backgrounds], poor households, and a stalling middle class,” according to the ITEP report.

For Latino and Black families, the economic outlook is bleak.

Wealth and Communities of Color

Income is already a rising issue.

Latino families have a median net worth of $21,000, respectively.

Black families have a median net worth of $17,000, respectively.

This is a fraction of the median net worth of white families, $171,000.

These numbers are even more disturbing ($3,400 for blacks, $6,300 for Latinos, respectively) when consumer durable goods, such as cars and home expenses, are factored in compared to their White counterparts ($140,500).

“For example, excluding durable goods and absent major federal policy intervention, current trends tell us that it will take median Latino families over 2,000 years just to match the wealth of White households today,” according to ITEP.

Furthermore, these economic divisions are often attributed to personal and individual choices such as marriage, college attainment, spending habits, etc.

In reality, many studies show the wealth divide persists across all levels of education attainment, and family structures. The “you chose that life” narrative is not valid.

The income and wealth divide is a result of treatment of communities of different backgrounds, such as massive federal investments that ultimately built the post-World War II middle class (i.e., New Deal & the GI Bill of 1944), according to ITEP.

How Tax Cuts Will Contribute to Overall Economic Divide

In 2017, Congress marketed the Tax Cuts and Jobs Act as a boost for the economic outlooks of working class families.

However, the law gives the nation’s highest income earning households more than two-and-a-half times the tax cuts it gives to the bottom 80% of households combined, according to the report.

“To put the level of inequality and unfairness of this tax law into perspective, the average yearly income of the richest 1% of households stands at about $1.8 million. For low-income households, it’s about $13,000 on average. This year, the Tax Cuts and Jobs Act will give the richest 1% of households an average tax cut of just over $47,000, while low-income households will get an average tax cut of just $90,” writes ITEP.

74% percent of Black and Latino households fall in the bottom 60% of taxpayers with incomes of $65,000 or less. In contrast, just 56% of White households fall in the bottom 60%.

Essentially, the rich get a much bigger tax cut in one day from the Tax Cuts and Jobs Act than the poorest families get in a year.

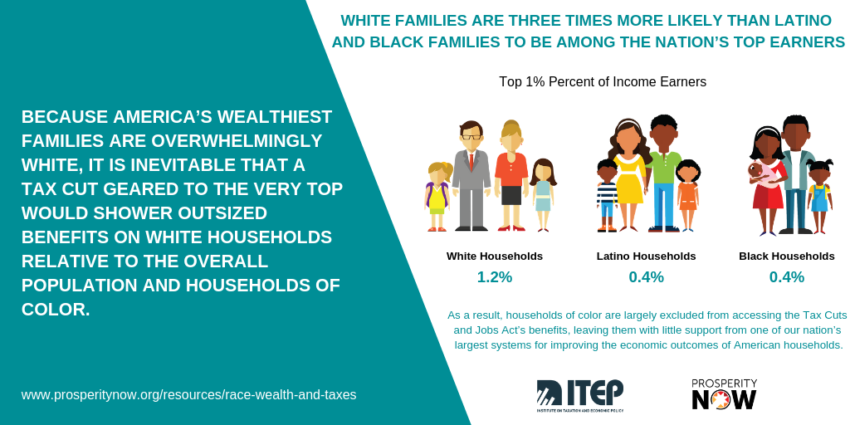

“Put another way, White families are three times more likely than Latino and Black families to be among the nation’s top earners,” according to the ITEP. “As a result, [these households] are largely excluded from accessing the Tax Cuts and Jobs Act’s benefits, leaving them with little support from one of our nation’s largest systems for improving the economic outcomes of American households.”

Of the nearly $275 billion within the Tax Cuts and Jobs Act in 2018, $218 billion (80%) goes to White households.

On average, White households will receive $2,020 in cuts, while Latino households will receive $970 and Black households receive $840.

“In the long term, this dynamic will not only exacerbate already tense economic insecurities so many households face today, but will also lead to even further economic hardships,” according to ITEP.

The ultimate goal should be to create a tax system that is fair for all, states ITEP.

Tax cuts should provide the greater wealth-building support to those who needed most, especially families who have been left behind by the system.

Explore More:

Understanding & Reducing PovertyBy The Numbers

23.7

percent

of Latino children are living in poverty