Share On Social!

As the longest U.S. government shutdown in history marches on, Latinos and the most vulnerable people face losing federal support for their very homes.

Tax credits are the U.S. government’s primary tool to encourage the development of affordable housing. The government grants the credits to developers, who then sell the credits to banks and other investors, who in turn use those credits to lower their own tax bills.

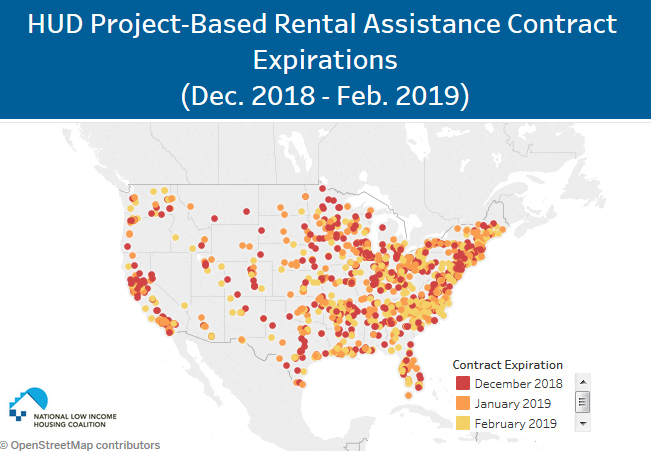

According to CNN, the shutdown, which started Dec. 22, 2018, is creating uncertainty for tens of thousands of low-income tenants who rely on the federal government to help pay their rent. The Department of Housing and Urban Development (HUD) hasn’t been able to renew about 1,650 contracts with private building owners who rent to low-income Americans and an additional 550 contracts are set to expire next month.

NBC News reports that a handful of federal HUD employees are still on the job are hard at work trying to find funding for affordable-housing contracts that have expired because of the government shutdown.

HUD has resorted to asking landlords to dip into their reserves rather than evict tenants, according to the Washington Post.

HUD has resorted to asking landlords to dip into their reserves rather than evict tenants, according to the Washington Post.

“The longer the shutdown continues, the more the lowest income people will be hard hit,” said Diane Yentel, head of the National Low Income Housing Coalition, in a statement. “Residents living in HUD-subsidized properties are some of our country’s most vulnerable people – the clear majority are deeply poor seniors, people with disabilities, and families with children. They rely on government assistance to remain housed, and a prolonged government shutdown puts them at increased risk of eviction and potentially homelessness.”

HUD has issued guidelines to give lenders and servicers a sense of the business they can and cannot do with HUD during this period.

“[The guidelines] include questions on the departments that will be open, submitting FHA mortgage insurance premiums, submitting loans for approvals as well as packages for condo approvals, payments to borrowers, FHA monitoring, and guidelines related to REO/HUD home sales,” according to Radhika Ojha of DSNews.

Bad News for Texas

This is especially bad news for Texas, which has been experiencing an affordable housing crisis since long before the shutdown.

The impact of the shutdown is being felt in Austin, where a development project that included 122 apartments earmarked for low-income residents is delayed because the developers applied for a HUD loan that is still in process, according to the Austin American-Statesman.

The impact of the shutdown is being felt in Austin, where a development project that included 122 apartments earmarked for low-income residents is delayed because the developers applied for a HUD loan that is still in process, according to the Austin American-Statesman.

“The longer the delay,” said Mark Gilbert, the county’s managing director of strategic planning, “the greater the potential for higher construction costs and interest rates.”

Prak Property Management Inc. has been digging into savings to keep some of its low-income properties in Austin running, according to KUT 90.5.

“It’s like a savings account that every month we are required to put a certain amount of dollars into for things like roofs, appliances, that sort of thing,” Brad Prak, a management agent with the Texas-based company, told the station.

Affordable Housing & Latino Health

Housing costs are usually the single largest expense for most households, and are a fundamental driver of where people live. As the cost of housing is barely sustainable, more and more economical backward class citizens are moving to areas where rents are lower but public transport is insufficient and poorly accessible.

Affordable housing is defined as that which costs no more than 30% of a household’s gross annual income.

Lack of affordable housing has strong implications for many Latinos and greatly impacts their quality of life.

Many Latinos live in racially segregated, low-income, high-poverty areas with limited access to fresh, healthy foods, quality healthcare, and physical activity spaces. Sadly, many Latino kids lack access to active spaces in their neighborhoods, according to Salud America! research.

Studies suggest the average white family experienced an 11% reduction in wealth.

But the average black family lost 31% of its wealth, and the average Latino family 44.7%.

Encouraging More Affordable Housing

Check out these stories about how cities and programs are finding unique ways to boost affordable housing for Latino and all people:

- Helping Latinos with Affordable Housing

- Major steps toward Affordable housing in Austin, Texas

- The midterm Big Wins (and Losses) for Affordable housing

- San Antonio’s Daring New Polices for Affordable housing

What can your city do, even in a time of government shutdown?

Explore More:

HousingBy The Numbers

56.9

percent

of Latinos are "housing cost burdened"