Share On Social!

A soda tax aims to reduce sugary drink consumption and boost public health.

In a new twist, Seattle is using soda tax revenues to give emergency $800 grocery vouchers for 6,250 families amid the coronavirus COVID-19 pandemic, Next City reports.

City leaders mailed a $400 voucher in March 2020 for families to buy groceries at Safeway. They will send a second $400 voucher this month.

Mayor Jenny Durkan called this rapid-response to coronavirus “remarkable.”

“As schools and child care facilities close, we need to do everything we can to support families and ensure they can put food on the table,” Durkan said, Next City reports.

Sugary drinks do not contribute to good health, especially among Latinos, according to a Salud America! research review.

Let’s examine how soda taxes are working.

Do Soda Taxes Reduce Sugary Drink Consumption?

A soda tax can reduce purchases of sugary drinks, according to a recent study from Mathematica Policy Research and others.

Researchers examined the impact of soda taxes in Philadelphia, San Francisco, Seattle, and Oakland. They compared changes in household monthly purchases to nearby cities and a matched set of households nationally.

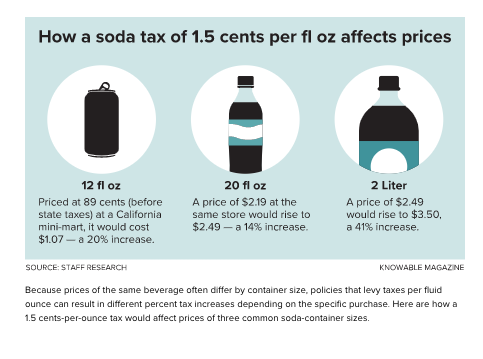

A 1-cent-per-ounce tax decreased household purchases of taxed sugary beverages by 53 ounces per month—a 12.2% decrease.

A 1-cent-per-ounce tax decreased household purchases of taxed sugary beverages by 53 ounces per month—a 12.2% decrease.

“This impact is small in magnitude and consistent with a reduction in individual consumption of 5 calories per day per household member and eventual reduction in weight of 0.5 pounds,” the researchers wrote in the study.

Seattle sugary drink sales dropped by 30%.

Researchers found a slight decrease in consumption, too.

Lower-income children in Seattle are drinking less pop than before the soda tax. But so are children who live outside the city, The Seattle Times reports.

In Philadelphia, a new study from Drexel University found that a year after the soda tax, 39% of participants inside the city and 34% of participants from neighboring areas said that they had consumed fewer sugar-sweetened beverages.

“Although this proportion may seem significant, for Philadelphians, it actually only translates to consuming three fewer drinks per month,” according to the study, wrote Medical News Today. “This is not at all a drastic change from the trends at baseline.”

Even if the reduced consumption is mild, the soda tax still benefits public health, experts say.

“Although this law was not passed for health reasons, the tax has the potential to generate long-term health benefits for many Philadelphians,” said Dr. Brent Langellier of Drexel University, according to Medical News Today. “Because revenue from the tax is being directed toward expanding access to quality early childhood education for children in lower income [households] — and education has a positive effect on many health outcomes.”

How Are Soda Taxes Funding Health?

Cities are using soda tax revenue to boost health.

- Berkeley, Calif. (11.4% Latino): This city implemented the first U.S. sugary drinks tax. The Praxis Project’s video series shows how tax revenue is making people healthier, from schools to families to the arts.

- San Francisco (15.2% Latino): Revenue from the 1 cent-per-ounce tax funds preventive health services in low-income communities. It also funds programs to improve school nutrition and oral health.

Seattle (18.3% Latino): Revenue from the 1.75 cent-per-ounce tax funds programs that help low-income people buy healthy food. It also helps subsidize schools and child care centers to increase servings of fruits and vegetables.

Seattle (18.3% Latino): Revenue from the 1.75 cent-per-ounce tax funds programs that help low-income people buy healthy food. It also helps subsidize schools and child care centers to increase servings of fruits and vegetables.- Philadelphia (15.2% Latino): A 1.5-cent-per-ounce Sweetened Beverage Tax took effect January 2017. The measure is working, health experts say. Revenue is going to early childcare programs. It also is improving local parks, though progress is slow.

- Washington, D.C. (11.3% Latino): City leaders are currently debating a soda tax that would yield $3 million per year. The money would help pay for a new nutrition program. Certain residents with a doctor’s prescription can get a $20 voucher for fruits and vegetables at supermarkets.

- Other cities have passed such taxes, including Albany and Oakland, Calif., as well as Boulder, Colo. They are also funding public health prevention programs.

In Seattle, the soda tax yielded $22.4 million in revenue in its first year. City leaders passed a law “establishing a fund that would restrict the money exclusively to healthy food initiatives,” according to Next City.

Now they are using $5 million to provide the vouchers amid COVID-19.

“Revenue from the tax is being invested in health and wellness across the city,” said Nancy Brown of AHA in a statement.

Moving Beyond Soda Taxes

Sugary drink taxes are among five pediatrician-approved recommendations to limit sugary drinks.

Sugary drink taxes are among five pediatrician-approved recommendations to limit sugary drinks.

- Raise the price of sugary drinks.

- Reduce sugary drink marketing to children and teens.

- Remove sugary drinks from kid’s menus. Emphasize healthy drink options.

- Add accurate nutrition labels and information.

- Hospital should serve as models with policies to limit or discourage purchase of sugary drinks.

Salud America! also created an Action Pack to help school leaders push for Water Bottle Fountains. This refillable water station can boost access to water for Latino and all kids.

By The Numbers

74

percent

of Latino kids have had a sugary drink by age 2 (vs. 45% of white kids)