Share On Social!

Life happens.

Would you be able to come up with $1,000 for an emergency like a car wreck, a broken arm, or a busted air conditioner?

Sadly, 61% of Latino and all Americans say they could not pay for an unplanned emergency expense, according to a report by financial site Bankrate.

“Even though unemployment is down and there’s been a recent uptick in wages, we aren’t seeing the needle move savings,” said Greg McBride of Bankrate told CNN Money.

“Even though unemployment is down and there’s been a recent uptick in wages, we aren’t seeing the needle move savings,” said Greg McBride of Bankrate told CNN Money.

Unexpected bills and expenses aren’t uncommon. More than 30% of all U.S. households had at least one unplanned expense in 2017.

But most Americans don’t have an ability to cover it.

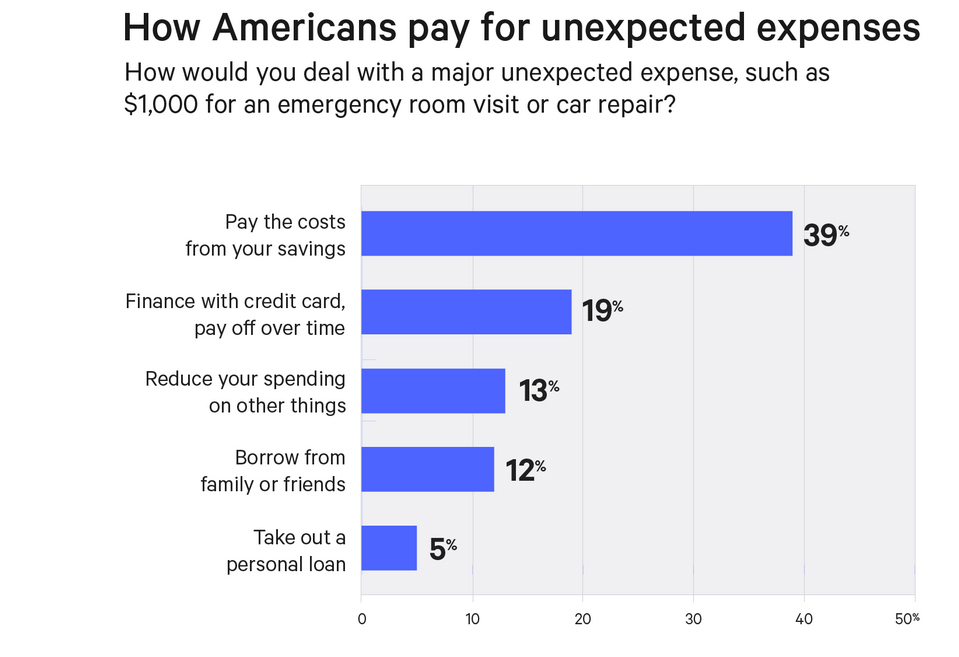

Almost one in five Americans said they would put the expense on a credit card, Bankrate reports. This usually makes the expense even higher in the long run due to interest rates.

Even worse, many Latinos tend to dip into their retirement.

About 34% of all Latinos surveyed have at least partially “tapped into” a retirement account to pay for unplanned expenses or medical emergencies. That’s more than their white (24%) and black (25%) peers.

Latinos are making gains in income, but poverty remains a problem. Wage gaps are growing for young millennials, too.

“In the last recession we had nearly 7 million people who were out of work longer than six months,” McBride told CNN Money. “To someone who doesn’t have any or very little extra funds, accumulating six months of expenses sounds like climbing Mount Everest, but that is the destination.”

So what can we do?

Explore the latest research on ways to support Latino families, and ways to limit Latinos’ time in poverty!

By The Numbers

142

Percent

Expected rise in Latino cancer cases in coming years