Share On Social!

Latinos now account for the majority of homeownership growth in the U.S., according to recent findings from the National Association of Hispanic Real Estate Professionals (NAHREP).

The report analyzes information such as labor force participation, household formation, median income, and aspirational interest, among other factors, to evaluate different demographics’ roles in overall homeownership gains. It also provides insight into how Latinos are fairing in the current housing market.

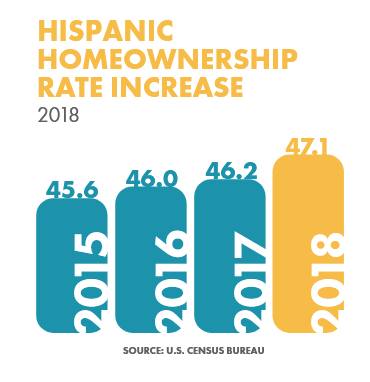

The data shows that Latinos are the only racial or ethnic demographic with positive homeownership rates over the last four years.

“Over the past decade, Hispanics have accounted for 62.7% of net U.S. homeownership gains, growing from 6,303,000 homeowners to 7,877,000, a total increase of 1,574,000 Hispanic homeowners,” the report states.

This is another example of how Latinos are powering the U.S. economy toward a better future.

Why Homeownership is Important for U.S. economy.

Homeownership is the primary ladder for American families to rise into the middle class and achieve a higher standard of living, making it a key socioeconomic gauge.

Homeowners are more likely to:

Homeowners are more likely to:

- Build and sustain wealth

- Pass wealthy to future generations

- Create stabler home environments

- Become invested in their schools and communities

A new fact sheet released by UnidosUS details trends in Latinos’ access, or lack thereof, to homeownership. Many organizations like UnidosUS continue to create programs that aim to prepare Latinos to become homeowners.

“The future of the housing market will depend on the ability of often-excluded individuals, including Latinos and other low- and moderate-income Americans, to obtain an affordable mortgage,” the publication states.

If homeownership is made more accessible, it will only be to the benefit of Latinos. Renting provides less economic benefits than buying a house according to Economy.

“Taking out a mortgage and investing in property is seen as a wise economic decision,” Economy states. “Instead of paying rent, homeowners can pay off their debts, accumulate wealth and have a home to live in, all at the same time.”

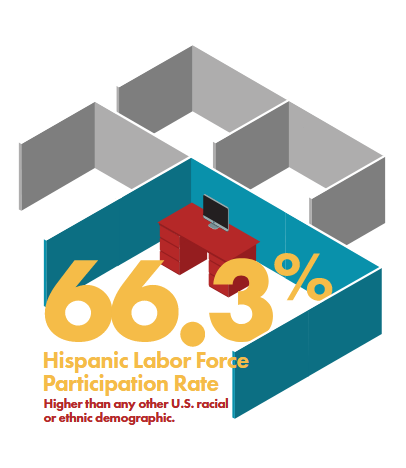

The NAHREP report suggests that Latinos have a higher labor force participation rate (66.3%) than non-Hispanic Whites (60.8%) and the overall U.S. average (60.9%).

Latinos currently make up 17% of the U.S. population — it could reach 30% by 2060.

If U.S. Latinos were their own nation, they would have the world’s seventh-largest gross domestic product, at $2.13 trillion, according to data from the Latino Donor Collaborative. That information helps to show that American Latinos are drivers in the growth of the U.S. workforce and economy.

Despite these gains, Latino and other minority youths still have higher rates of poverty and greater gaps in education, health equity than their white peers, according to a 2018 report by County Health Rankings.

Barriers and Obstacles for Latino Homeownership

Despite their outsized role in the market, Latinos experience numerous difficulties in homeownership.

The NAHREP report gives an overview of these hindrances.

Denied mortgages: “In 2016, Hispanic borrowers were denied a mortgage at a rate of 14.9%, as compared with the rate of denial to Whites, 9.4%.” Hence Latinos are more likely to be denied a loan than Whites.”

Denied mortgages: “In 2016, Hispanic borrowers were denied a mortgage at a rate of 14.9%, as compared with the rate of denial to Whites, 9.4%.” Hence Latinos are more likely to be denied a loan than Whites.”- Conventional loans: “Latinos received slightly more conventional loans in 2016 (5.8%) than in 2015 (5.1%), but their share of all conventional loans was Latinos received slightly more conventional loans in 2016 (5.8%) than in 2015 (5.1%), but their share of all conventional loans was [small]: Whites received more than 70% of conventional loans made.”

- Non-conventional loans: “Latinos are more likely to receive a non-conventional loan and pay more for a mortgage.” Latino homebuyers were more than twice as likely to use Federal Housing Administration loans to purchase a home.

- Lower Home Values: Latinos families borrowed an increase of $11,000 over the average amount to finance their home purchase.

The report also emphasized that while Hispanics represent a decreasing share of new immigrants, they do make up 95.7% of all deportations in 2018. These removals of long-term Latino residents who are undocumented create economic unrest in their communities, as well as lasting impacts on the U.S.-born children they leave behind.

Moreover, Black and Latino women with low-incomes were evicted at alarmingly higher rates than other racial groups due to factors such as having children, low wages, and landlord-tenant gender dynamics, according to recent studies from the Eviction Lab.

Check out more stories on housing and Latino health

Learn: Latinos & Affordable Housing!

Explore More:

HousingBy The Numbers

56.9

percent

of Latinos are "housing cost burdened"