Share On Social!

Close to 40% of Americans struggle to meet the rising costs of housing, and Latinos especially face hardship in affordable housing as the pandemic worsened inequities, says a new report.

As the economy recovers from the COVID-19 pandemic, Americans are struggling with soaring home and rent prices, affordability issues, and the risk of eviction and foreclosure, according to The State of the Nation’s Housing 2021 from Harvard University’s Joint Center for Housing Studies.

Latinos and other people of color are impacted on a greater scale.

Latinos and other people of color are impacted on a greater scale.

“Millions of households that lost income during the shutdowns are behind on their housing payments and on the brink of eviction or foreclosure,” the report states. “A disproportionately large share of these at-risk households are renters with low incomes and people of color.”

“While policymakers have taken bold steps to prop up consumers and the economy, additional government support will be necessary to ensure that all households benefit from the expanding economy.”

So what does the report say? What should be done?

In the Report: What Housing Inequities Do Latinos Face?

The Harvard study identified critical housing inequities:

- The pandemic has worsened the health disparities among Latinos. Even though differences in homeownership rates between households of color and white households remain substantial, the Latino-White gap decreased by 1.8% points between 2019 and the first quarter of 2021.

Income inequities contribute to disparities in homeownership. The median household income of white renters ($45,000) in 2019 was 40% higher than that of Black renters ($32,100) and 7% higher than that of Latino renters ($42,000).

Income inequities contribute to disparities in homeownership. The median household income of white renters ($45,000) in 2019 was 40% higher than that of Black renters ($32,100) and 7% higher than that of Latino renters ($42,000).- Only 12% of Latino renters had more than $10,000 in cash savings, compared with 25% of white renters.

- The share of renter households with cost burdens in 2019 was down. But racial/ethnic disparities remain, with 29% of Black and 21% of Latinos, compared with just 11% of white renters.

- The homes most in need of repair are manufactured housing units and units occupied by renters, largely those occupied by Black and Latinos.

- Among Latinos and Black, there are also significant differences in household wealth and financial resiliency. 47% of Latino adults would have enough cash to pay for an unexpected expense of $400, compared with 72% of white adults.

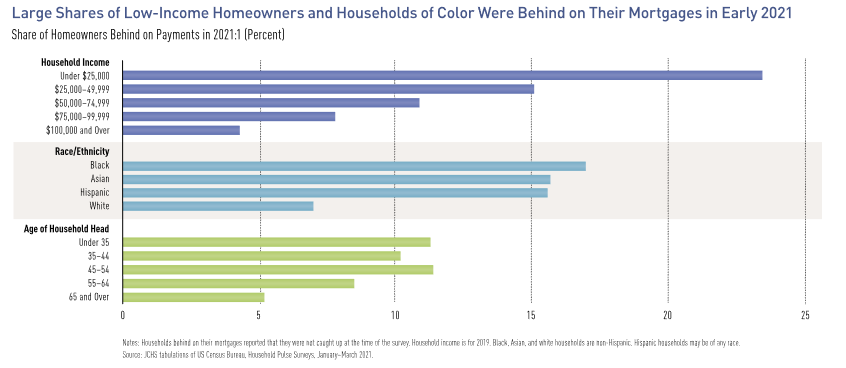

- In 2020, homeowners of color were hit especially hard by income losses. 50% of Latino homeowners lost income by the first quarter of this year, the highest among any ethnic group. As a result, 16% of Latino homeowners were behind on their mortgage payments in early 2021. That is more than twice the 7% share of white homeowners.

- 8.4% of Latino mortgage holders were in forbearance in March 2021.

- Households of color may be deterred from refinancing by relatively high denial rates and limited funds to cover the upfront costs. Only about a quarter of Latino homeowners and a fifth of Black homeowners refinanced their mortgages in 2019, compared with a third of white homeowners.

This data highlight serious concerns with homelessness and eviction.

“So far, substantial federal relief through stimulus payments, expanded unemployment benefits, and other funding, along with federal and state eviction moratoriums, have prevented large-scale displacement,” according to the report. “However, if the federal moratorium ends in July as scheduled (or earlier due to successful legal challenges), staving off a substantial increase in evictions and homelessness will depend on whether the latest round of assistance reaches at-risk households in time.”

In the Report: What Can Policymakers Do about Housing Inequities?

As a first step, the Harvard report suggests addressing the aging stock of homes.

More than a third of all occupied homes in 2017 had structural, plumbing, electrical, and heating problems, leaks, and/or pest infestations, according to a study cited by the report.

The cost of repair would exceed $125 billion. Not to mention other upgrades.

“Among the homes most in need of repair are manufactured housing units, units occupied by renters, and those occupied by Black, Hispanic, and Native American/Alaskan Native households, as well as by people with disabilities,” the report states.

Also, a recent Joint Center analysis found that a $15,000 income-targeted assistance program could help as many as 1 million Black renters and 470,000 Latino renters buy homes.

Coupled with home-buyer education and counseling to overcome information and credit barriers, this support has the potential to reduce the Black-white homeownership gap by 12 percentage points and the Latino-white gap by 4 percentage points.

Coupled with home-buyer education and counseling to overcome information and credit barriers, this support has the potential to reduce the Black-white homeownership gap by 12 percentage points and the Latino-white gap by 4 percentage points.

“To sustain vibrant housing markets, policymakers must take measures now to reinvigorate population growth through increased immigration, promote higher birth rates through support for working families, and reduce the drag on economic growth from income and wealth disparities and more immediately, it is vital that policymakers take steps to ensure mortgage borrowers that suffered financial setbacks during the pandemic are able to stave off the loss of their homes,” according to the Harvard report.

This is especially critical for Latinos.

Before the pandemic, U.S. Latinos already lacked affordable housing and unreliable public transportation, according to a Salud America! research review.

“Cities and community partners are increasingly pushing for more affordable housing. This can be achieved through easing zoning standards, buying land to give to affordable developers, adding low-income units in mixed-income housing developments, and setting up affordable housing trust funds for future projects,” according to the research review. “Localities can help keep renters in their homes with rental housing assistance or repair programs. Rent-controlled units for low-income workers are another emerging option.”

Learn more about Latino housing.

How Can You Get Involved to Improve Health Equity in Housing and More?

Just download a Salud America! Health Equity Report Card.

The report card will show you how you will see how people in your county are experiencing cost-burdened housing, substandard housing, mortgage lending, and more. The data is compared to the rest of your state and nation with maps and gauges.

Email your Health Equity Report Card to community leaders and share it on social media. Use it to make the case to address healthy food access where help is needed most!

By The Numbers

56.9

percent

of Latinos are "housing cost burdened"