Share On Social!

Latinos are the nation’s largest minority, making up 18.5% of the population.

This dynamic population is also helping fuel the red-hot housing market, even amid COVID-19.

“The number of Hispanic-homeowner households rose by more than 700,000 to nearly 9 million in 2020, according to Census Bureau data compiled by the National Association of Hispanic Real Estate Professionals, an industry group. Those gains marked the biggest one-year increase in data on Hispanic homeownership going back two decades,” the Wall Street Journal reported in April 2021.

Let’s explore the this surge in the Latino housing market, challenges, and the future of housing.

What’s Causing the Surge in the Latino Housing Market?

The Latino homeownership rate has “increased more during the past several years than any race or ethnic group, including whites,” according to the Wall Street Journal.

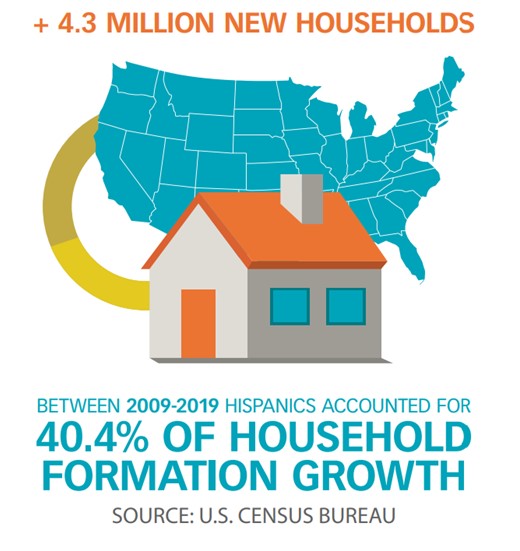

Between 2009 and 2019, Latinos accounted for 40.4% of household formation growth in the United States.

This is due to the youth of the population.

For example, 4.9 million Latino millennials (ages of 22-37) were “mortgage ready” in 2018, housingchannel reports.

For example, 4.9 million Latino millennials (ages of 22-37) were “mortgage ready” in 2018, housingchannel reports.

“[Latino home-buying power] continues to grow as individuals enter their early 30s, the most typical years for first-time home buyers,” according to the report. “Hispanics in the U.S. had a median age of 30 in 2019, which was about 14 years younger than the median age for non-Hispanic white Americans.”

A blog post by the Urban Institute explains further.

“First, Hispanic households are much younger than their Black and white counterparts; a much higher proportion are in their twenties, thirties, and forties, when households tend to buy their first home,” according to the post.

“Second, as discussed in our report, Hispanic households are the only group holding the homebuying ground. At any given age, Hispanic households are buying at rates similar to past generations.”

How Has the COVID-19 Pandemic Impacted the Latino Housing Market?

Amid the surge of the Latino housing market, not all Latinos are faring well.

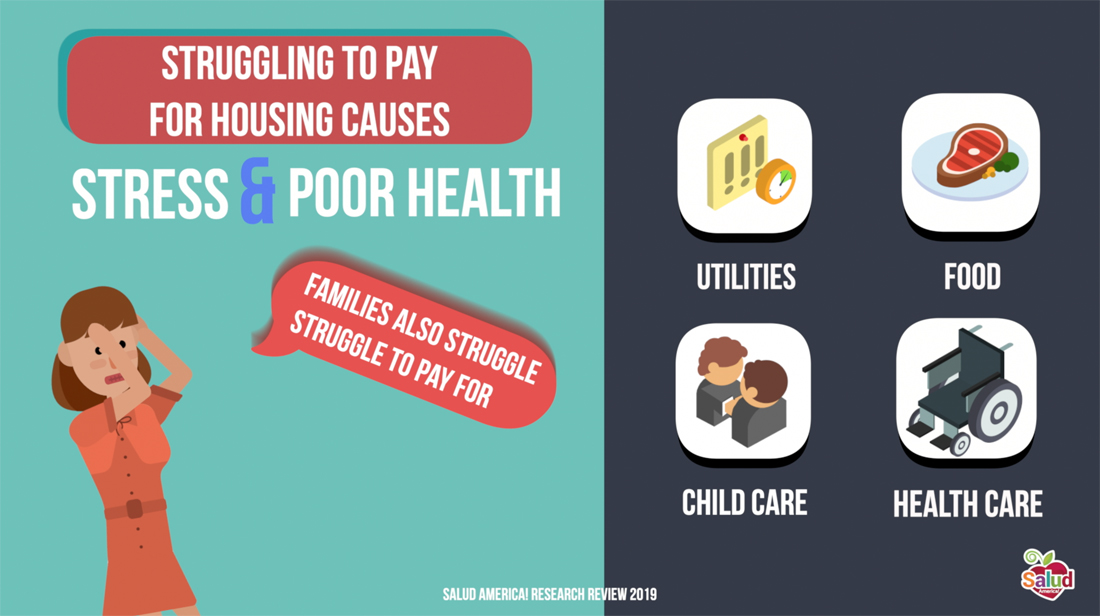

Before the COVID-19 pandemic, many Latinos faced a lack of affordable housing, according to a Salud America! research review.

Lack of affordable housing can dramatically impact quality of life. Latinos who can’t pay rent, mortgage, or bills are less likely to have a usual source of medical care. They also are more likely to postpone needing treatment than those who have more affordable housing.

Lack of affordable housing can dramatically impact quality of life. Latinos who can’t pay rent, mortgage, or bills are less likely to have a usual source of medical care. They also are more likely to postpone needing treatment than those who have more affordable housing.

“The percentage of Latinos who are ‘housing cost burdened,’ spending 30% or more of household income on housing costs, grew from 42.4% in 2000 to 56.9% in 2015,” according to the report.

Since the pandemic, close to 40% of Americans struggle to meet the rising costs of housing.

This is especially true for Latinos, who have suffered worsened inequities, according to a recent report from Harvard University.

“In 2020, homeowners of color were hit especially hard by income losses. 50% of Latino homeowners lost income by the first quarter of this year, the highest among any ethnic group,” according to the Harvard report.

What Does the Future of the Latino Housing Market Look Like?

Housing market experts continue to indicate that Latinos will drive the housing market.

NAHREP’s 2020 State of Hispanic Homeownership Report found that the homeownership rate among Latinos increased to roughly 49% in 2020, up from 47.5% the year prior. That accounts for an additional 725,000 new household owners in 2020.

“Despite significant headwinds, Latinos drove homeownership growth in America for the sixth consecutive year,” said Gary Acosta of NAHREP in a statement. “This was especially consequential in 2020 because it was housing more than any other sector that pulled the country out of the coronavirus-induced recession.”

This pattern is expected to continue.

Between 2020 and 2040, 70% of new homeowners will be Latinos, according to the Urban Institute’s blog post.

Between 2020 and 2040, 70% of new homeowners will be Latinos, according to the Urban Institute’s blog post.

“For Latino households, owning a home is a central part of building a solid financial foundation, and increasing wealth over time,” according to George Ratiu, an economist with realtor.com. “This preference became even more important during 2020, as the COVID pandemic accelerated many people’s reach for the safety of a home and the space to work, live, and school children.”

The housingchannel agrees.

“It will be the Latino community’s youth, strong work ethic and desire for homeownership that will once again drive homeownership growth as the country rebounds from a post-pandemic economy,” according to the housingchannel.

Still, the pandemic will undoubtedly make homeownership harder for some Latinos.

“Our analysis shows steep increases in Hispanic homeownership over the coming decades, but these households face significant barriers—including putting together a down payment with less income, tight credit standards, and an affordable housing supply crisis,” according to the Urban Institute’s blog post.

What Can We Do to Improve Affordable Housing?

Check out six emerging ways cities can solve the affordable housing crisis here.

In addition, the Urban Institute shared these three key issues:

In addition, the Urban Institute shared these three key issues:

- Expand the use of down payment assistance. “Accordingly, increasing the visibility of and opportunities for housing counseling and financial education about down payment assistance and the basic facts about down payments could support the growth in Hispanic homeownership.”

- Expand access to mortgage credit. “The housing industry must rethink how it qualifies borrowers for mortgages,” and much more.

- Support an increased supply of affordable housing and allow for more multigenerational living at the local level. “Lack of affordable housing units is making housing more expensive for both renters and homeowners. To bring down the costs of housing production, including land costs, zoning and land-use regulations must be revised to increase density and promote more inclusionary zoning and land-use regulation; the permitting process must be expedited; and new cost-saving technologies must be embraced.”

See what housing inequities face your community.

Just download a Salud America! Health Equity Report Card. The report card will show you how many people in your county experience cost-burdened housing, substandard housing, mortgage lending, and more. The data uses maps and gauges to compare your county with the rest of your state and nation.

Email your Health Equity Report Card to community leaders and share it on social media. Use it to make the case to address healthy food access where help is needed most!

Explore More:

HousingBy The Numbers

56.9

percent

of Latinos are "housing cost burdened"